Steelcase Inc.today reported first-quarter revenue of $482.8 million and a net loss of $38.1 million, or a loss of $0.33 per share. The results included a non-cash goodwill impairment charge which increased the net loss by $17.6 million, or $0.15 per share. The adjusted net loss in the quarter totaled $20.5 million, or $0.18 per share. In the prior year, Steelcase reported $824.3 million of revenue and net income of $17.8 million, or diluted earnings of $0.15 per share.

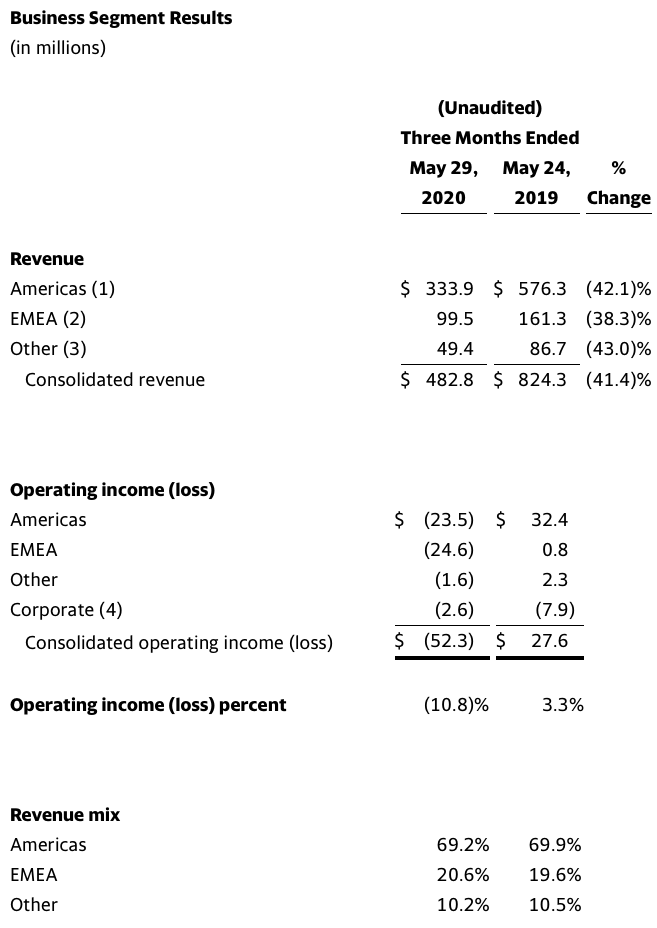

Revenue decreased 41 percent in the first quarter compared to the prior year. The decline was broad-based across all segments as government mandates significantly limited the company's ability to manufacture and fulfill orders throughout much of the world during the first quarter. Revenue in the Americas declined 42 percent and EMEA declined 38 percent compared to the prior year. The Other category declined 43 percent, or 28 percent on an organic basis after adjusting for the impact of the PolyVision divestiture in February 2020 and currency translation effects.

Orders (adjusted for currency translation effects and the impact of the PolyVision divestiture) declined 34 percent in the first quarter compared to the prior year, which grew 15 percent against the first quarter of fiscal 2019. The decline was broad-based across all segments. Orders declined 16 percent in March, 47 percent in April and 42 percent in May compared to the prior year. Going into the second quarter, orders declined an average of 34 percent during the first four weeks of June compared to the prior year.

As of May 29, 2020, the company’s backlog of customer orders was $751 million, or 11 percent higher than the prior year, due to the pandemic-related restrictions on manufacturing and delivery activities. All of the company's manufacturing and distribution facilities are currently open, and the company expects to manufacture and ship most of its current backlog during the second quarter.

"The global pandemic dramatically interrupted our momentum from a very strong fiscal 2020," said Jim Keane, president and CEO. "Suddenly, we were closing plants and taking actions to protect employees and preserve capital. Instead of permanent layoffs, we helped temporarily-idled employees access government programs, while paying the full cost of their health care premiums. Salaried workers took significant pay cuts, with higher-paid people taking the deepest cuts. As we began to ramp up manufacturing of essential business orders, we were able to ease the pay reductions and call back our hourly production employees. Because we were able to increase production sooner and faster than we expected, our revenue for the quarter was slightly better than some scenarios we modeled.”

The first quarter operating loss of $52.3 million represented a decrease of $79.9 million compared to operating income of $27.6 million in the prior year, due primarily to the significant decline in revenue across all segments. Excluding the goodwill impairment charge (which was recorded in the EMEA segment), the adjusted operating loss was $34.7 million. The Americas reported an operating loss of $23.5 million compared to operating income of $32.4 million in the prior year. EMEA reported an operating loss of $24.6 million, or an adjusted operating loss of $7.0 million, compared to operating income of $0.8 million in the prior year. The Other category reported an operating loss of $1.6 million compared to operating income of $2.3 million in the prior year, which included $1.8 million from PolyVision.

Gross margin of 25.4 percent in the first quarter represented a decrease of 590 basis points compared to the prior year, with a 730 basis point decline in the Americas, a 400 basis point decline in EMEA and a 30 basis point decline in the Other category. On a consolidated basis, the decline was driven by lower revenue and absorption of fixed costs, as well as inefficiencies related to labor and logistics utilization due to the disruption experienced during the quarter, partially offset by pay reductions for salaried employees, favorable shifts in business mix, lower overhead costs, pricing benefits and lower variable compensation expense.

Operating expenses of $157.4 million in the first quarter represented a decrease of $73.4 million compared to the prior year. The decrease was driven by temporary reductions in pay and hours across most of the company's global salaried workforce, lower variable compensation expense, near elimination of travel, events and contract labor costs and significant reductions to project spending. The salary reductions were implemented in March and varied on a country-by-country basis, averaging approximately 50 percent in the U.S. and parts of EMEA for six weeks or more, and were eased to an average reduction of approximately 20 percent in most markets by the end of the quarter.

“The significant restrictions on our factories necessitated the speed and depth of our actions to implement temporary layoffs of our manufacturing and distribution employees, significantly reduce salaries and semi-variable costs, and curtail project and other discretionary spending,” said Dave Sylvester, senior vice president and CFO. “As our factories were forced to idle, the layoffs allowed our variable margins to largely remain intact, and we estimate the other reductions lowered our average weekly costs compared to the fourth quarter and saved us approximately $70 million in total for the quarter, spread across cost of goods sold and operating expenses.”

The operating loss in the first quarter included a $17.6 million goodwill impairment charge that primarily resulted from the impacts of the pandemic and related economic uncertainty.

Interest expense of $7.3 million in the first quarter represented an increase of $0.6 million compared to the prior year primarily due to outstanding borrowings under the company's global credit facility during the quarter.

Other income, net increased by $1.8 million compared to the prior year, due to a $2.8 million gain related to additional proceeds from the partial sale of an unconsolidated affiliate in 2018, partially offset by lower income from other unconsolidated affiliates.

The company recorded an income tax benefit of $16.7 million in the first quarter, which represented an effective tax rate of approximately 30 percent and included $10.0 million of net tax benefits related to the U.S. Coronavirus Aid, Relief, and Economic Security Act. Adjusted for those benefits, as well as the non-deductible goodwill impairment charge, the company's effective tax rate approximated 18 percent in the first quarter. In the prior year, income tax expense was $6.3 million and represented an effective tax rate of approximately 26 percent.

Total liquidity, comprised of cash, cash equivalents and the cash surrender value of company-owned life insurance, aggregated to $799.0 million. The cash balance included $123.4 million of customer deposits at the end of the quarter, compared to $28.6 million as of the beginning of the quarter, driven by temporary incentives which encouraged deposits from dealers.

Total debt was $728.9 million at the end of the first quarter which included $245.0 million in outstanding borrowings under the company's global credit facility.

“We started the second quarter with $751 million in our customer order backlog and nearly $800 million of liquidity,” said Dave Sylvester. “We expect our second quarter revenue and operating results will benefit from the high level of backlog and maintaining our salary reductions and other cost containment efforts, and by the end of the second quarter, we anticipate having positive adjusted operating income for the year to date. We believe the strength of our liquidity position will provide ballast over the course of the year as we navigate the economic uncertainty.”

During the first few weeks of March (ending on March 20, 2020), the company repurchased, through a Rule 10b5-1 plan established in December 2019, 3.0 million shares of its Class A Common Stock at an aggregate cost of $38.6 million, which represented the total amount authorized under that plan.

The Board of Directors has declared a quarterly cash dividend of $0.10 per share, to be paid on or before July 15, 2020, to shareholders of record as of July 8, 2020.

“Customers are facing an uncertain environment as they contemplate how to support their people as they work from home and how to safely return to office-based work," said Jim Keane. “We are providing programs through which clients can provide their employees safe, efficient and productive solutions for the home. We are also engaging with clients as they prepare for the early stages of a return to the office but also as they look to reinvent the office to flexibly support higher levels of creativity, innovation and productivity.”

Business Segment Footnotes

The Americas segment serves customers in the U.S., Canada, the Caribbean Islands and Latin America with a portfolio of integrated architecture, furniture and technology products marketed to corporate, government, healthcare, education and retail customers through the Steelcase, Coalesse, Turnstone, Smith System, AMQ and Orangebox brands.

The EMEA segment serves customers in Europe, the Middle East and Africa primarily under the Steelcase, Orangebox and Coalesse brands, with an emphasis on freestanding furniture systems, storage and seating solutions.

The Other category includes Asia Pacific and Designtex. In 2020, the Other category also included PolyVision, which was sold in February 2020.

Corporate costs include unallocated portions of shared service functions, such as information technology, corporate facilities, finance, human resources, research, legal and customer aviation, plus deferred compensation expense and income or losses associated with company-owned life insurance.