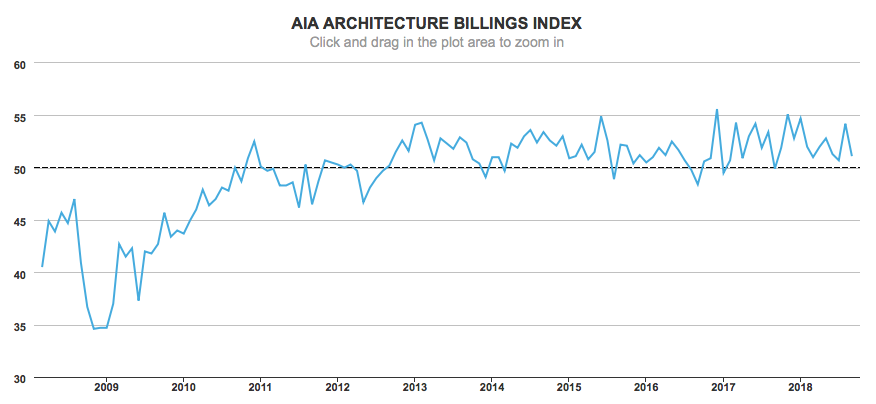

The AIA's monthly Architecture Billings Index (ABI) came in at a score of 51.1 in September, marking the 12th consecutive month of gains. The ABI is a leading economic indicator of construction activity in the U.S., and reflects a nine- to 12-month lead time between architecture billings and construction spending nationally, regionally, and by project type. A score above 50, as seen in September, represents an increase in billings from the previous month, while a score below 50 represents a contraction.›

September's score is 3.1 points lower than August's reading of 54.2, indicating that the industry is still growing, but at a slower pace.

“Similar to the strong conditions we’ve seen nationally, architecture firms located in the Midwest and Southern regions of the country continued to report very strong billings in September,” said AIA chief economist Kermit Baker, Hon. AIA, in a press release. “However, billings were soft at firms located in the Northeast again, where they have declined or been flat for the entire year so far.”

In September, design contracts posted a score of 54.1—a 4.5-point increase from August's score of 49.6, a sign that momentum is getting strong again after the score dropped below the 50-point threshold in August.

The scores for regional billings—which, unlike the national score, are calculated as a three-month moving averages—decreased in three regions in September. The billings score for the West dropped 1.1 points to a score of 53.1. Demand for design services in the South decreased by 2.9 points to a score of 54.1. Billings also decreased in the Northeast by 0.3 points, to a score of 46.6. Demand for design services increased significantly by 7.2 points to a score of 59.7 in the Midwest.

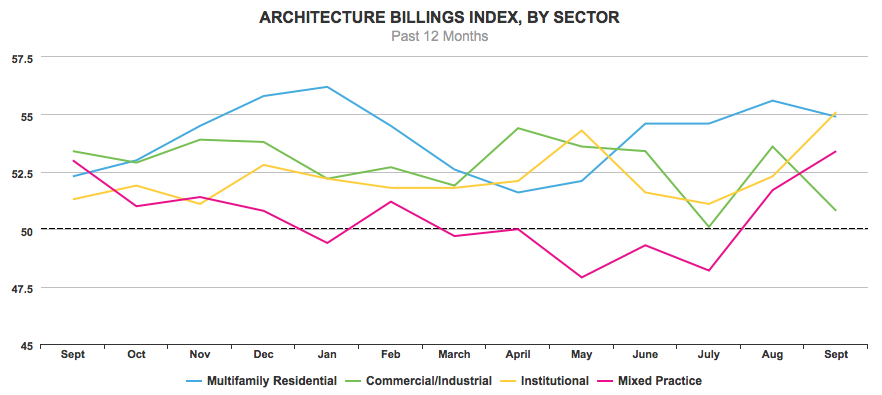

Billings decreased in two of the four individual industry sectors in September, but all posted a score above 50, indicating growth. The multifamily residential score dropped by 0.7 point to a score of 54.9 and the commercial/industrial sector's score decreased by 2.8 points to a score of 50.8. The institutional sector grew 2.8 points to a score of 55.1. And the mixed-use sector posted a score of 53.4, a 1.7-point increase from August's score of 51.7. (Results of sectors are also calculated as three-month moving averages.)